KYC-Approved USA Accounts Crypto & Payment Accounts (Fully Verified & Ready to Use)

Looking for KYC-Approved USA Accounts that bypass weeks of verification waiting? BuyVerifiedUSA provides fully verified, ready-to-use crypto exchange and payment processor accounts specifically approved for United States users. Our KYC-approved accounts come with complete Level 2 verification, USA residential documentation, SSN verification completed, and instant access to trading, sending, and receiving capabilities on platforms like Coinbase, Binance.US, PayPal, Stripe, Cash App, and 20+ major services.

Why spend 10-15 days struggling through complex USA KYC requirements when you can start trading or processing payments within 24 hours? Our premium KYC-approved USA accounts arrive with authentic verification completed through legitimate channels, including government-issued ID confirmation, Social Security Number verification, USA address validation, bank account linking, and enhanced security setup – ensuring you meet strict American regulatory compliance from day one.

Whether you’re an international user needing USA market access, an American entrepreneur launching online business operations, a crypto trader requiring instant exchange access, or a merchant needing payment processing capabilities, our KYC-approved accounts provide the complete solution. Each account passes rigorous USA-specific compliance checks including FinCEN requirements, state money transmitter regulations, IRS reporting standards, and platform-specific verification protocols.

What makes BuyVerifiedUSA the trusted choice for KYC-approved USA accounts? We’re USA-based compliance experts since 2022 with 500+ successful account deliveries, zero suspension incidents, and deep knowledge of American financial regulations. Our accounts feature authentic USA verification documentation, real residential addresses, legitimate SSN processing, and complete regulatory compliance. When you buy KYC-approved USA accounts from us, you’re partnering with professionals who understand both American regulations and platform requirements, delivering accounts that work perfectly for years without issues.

What Are KYC-Approved USA Accounts and Why They Matter?

Understanding KYC-Approved Accounts for USA Platforms

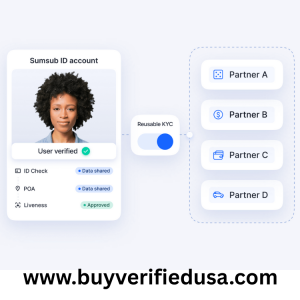

KYC-approved USA accounts represent fully verified financial service accounts that have successfully completed all Know Your Customer requirements specifically mandated for United States users by American regulatory authorities. These accounts differ fundamentally from standard international accounts due to USA’s uniquely strict financial compliance framework involving multiple federal agencies, state-level regulations, and platform-specific enhanced verification procedures.

What Makes USA KYC Different and More Complex: KYC-Approved USA Accounts

USA financial platforms implement the world’s most stringent verification processes due to comprehensive regulatory oversight from the Financial Crimes Enforcement Network (FinCEN), Internal Revenue Service (IRS), Securities and Exchange Commission (SEC), state banking departments, and money transmitter licensing authorities. American KYC verification typically requires government-issued photo identification with Real ID compliance, Social Security Number verification through official SSA databases, USA residential address confirmation via credit bureau checks, bank account validation through micro-deposit verification, and enhanced background screening including OFAC sanctions lists and FinCEN suspicious activity databases.

The complexity intensifies because USA platforms must comply with the Bank Secrecy Act requiring detailed customer information collection, USA PATRIOT Act mandating enhanced due diligence for certain customers, state money transmitter laws varying across all 50 states, IRS Form W-9 requirements for tax reporting, and SEC regulations when securities or investment products are involved. International users face additional barriers including proof of USA residency that many cannot provide, SSN requirements impossible for non-Americans to satisfy, USA bank account prerequisites for fiat transactions, and systematic rejection of foreign identification documents.

Why KYC-Approved USA Accounts Provide Critical Advantages: KYC-Approved USA Accounts

The USA financial services market represents the world’s largest and most liquid ecosystem, with American crypto exchanges offering the deepest order books and tightest spreads globally. USA payment processors provide access to 330 million American consumers with the world’s highest per-capita spending power. Major platforms like Coinbase, Binance.US, Kraken, PayPal, Stripe, and Square primarily serve USA markets with features unavailable elsewhere. International users purchasing KYC-approved USA accounts gain immediate market access that would otherwise require USA residency, American citizenship or green card status, USA banking relationships, and months of complex verification processes.

American entrepreneurs benefit equally from KYC-approved accounts that eliminate verification delays preventing business launches. New businesses face chicken-and-egg problems where payment processors require operating history before approval, but generating revenue requires approved payment processing. Startups struggle with founder verification when incorporating directors lack perfect credit or documentation. E-commerce sellers miss seasonal opportunities waiting for merchant account approvals during critical holiday periods. KYC-approved USA accounts solve these problems immediately, allowing instant business operations without verification bottlenecks.

Types of KYC-Approved USA Accounts We Provide

Our comprehensive KYC-approved USA account service covers all major categories of American financial platforms, each with specific verification requirements and use cases:

Cryptocurrency Exchange Accounts (USA-Specific)

Coinbase Accounts (KYC-Approved): America’s largest crypto exchange with 108 million users and the only major exchange offering full USA regulatory compliance. Our KYC-approved Coinbase accounts include Level 2 verification completed with $50,000 daily trading limits, instant ACH deposits from USA bank accounts, full access to Coinbase Pro advanced trading, staking for 15+ cryptocurrencies, Coinbase Card debit card eligibility, and complete withdrawal freedom to USA bank accounts or external wallets.

Binance.US Accounts (KYC-Approved): The American subsidiary of Binance specifically designed for USA regulatory compliance, available in 45+ states. KYC-approved Binance.US accounts feature complete identity verification, $10,000+ daily withdrawal limits, access to 65+ cryptocurrencies unavailable on international Binance for Americans, competitive 0.1% trading fees, ACH deposit capability, and state-specific compliance ensuring legal operation.

Kraken Accounts (KYC-Approved): Premier USA exchange known for institutional-grade security and advanced trading features. Our KYC-approved Kraken accounts include Intermediate or Pro verification levels, $100,000+ daily limits, margin trading up to 5x leverage, futures trading capabilities, OTC desk access for large orders, and full USA regulatory compliance.

Gemini Accounts (KYC-Approved): New York-based exchange founded by Winklevoss twins with banking charter and insurance coverage. KYC-approved Gemini accounts provide FDIC insurance on USD deposits (through partner banks), USA regulatory approval in all 50 states, instant trading with linked bank accounts, Gemini Earn interest program access, and ActiveTrader platform for professionals.

Payment Processor Accounts (USA-Verified)

PayPal Business Accounts (KYC-Approved): The world’s most widely accepted online payment processor with 400+ million users. Our KYC-approved PayPal accounts include full business account verification, unlimited transaction capability, withdrawal to USA bank accounts, PayPal Credit line eligibility, merchant services with shopping cart integration, buyer and seller protection coverage, and complete USA compliance.

Stripe Atlas Accounts (KYC-Approved): Premium payment processing for internet businesses with global reach but USA foundation. KYC-approved Stripe accounts feature complete merchant verification, ability to accept 135+ currencies, support for all major credit cards, ACH direct debit processing, recurring billing and subscription management, radar fraud protection, and comprehensive API access for developers.

Square/Block Accounts (KYC-Approved): Integrated payment ecosystem from Jack Dorsey’s Block Inc. offering point-of-sale and online processing. KYC-approved Square accounts provide instant merchant approval, in-person card reader compatibility, online checkout integration, Cash App Business connectivity, next-day deposit capability, and full USA merchant services.

Venmo Business Profiles (KYC-Approved): Social payment platform owned by PayPal with 90 million USA users and unique merchant features. KYC-approved Venmo accounts include business profile verification, payment acceptance from Venmo’s massive USA user base, social feed marketing opportunities, seamless PayPal integration, and instant transfer to bank accounts.

Digital Banking & Fintech Accounts

Chime Bank Accounts (KYC-Approved): Leading USA neobank with no fees, early direct deposit, and automatic savings. KYC-approved Chime accounts feature full checking account functionality, FDIC insurance through partner banks, SpotMe overdraft protection up to $200, early paycheck access up to 2 days early, and debit card with no foreign transaction fees.

Cash App Accounts (KYC-Approved with Bitcoin): Multi-functional app combining peer-to-peer payments, stock investing, and Bitcoin trading. KYC-approved Cash App accounts include full verification enabling $7,500 weekly limits, Bitcoin buying/selling/withdrawal capabilities, stock and ETF investing, Cash Card debit card, and direct deposit for paychecks.

Revolut USA Accounts (KYC-Approved): European fintech expanding aggressively in American markets with premium features. KYC-approved Revolut USA accounts provide multi-currency accounts, cryptocurrency trading for 30+ coins, stock trading with fractional shares, budgeting and analytics tools, metal card options, and travel benefits.

Why Buy KYC-Approved USA Accounts Instead of Self-Verification?

USA Verification Challenges for International Users

International individuals and businesses face systematic barriers accessing USA financial platforms that make self-verification extremely difficult or completely impossible:

The SSN Requirement Problem: Most USA platforms require Social Security Numbers for identity verification and IRS tax reporting compliance. Non-USA residents cannot obtain SSNs without work authorization or specific visa types, creating an insurmountable barrier. Some platforms accept ITIN (Individual Taxpayer Identification Number) as alternatives, but obtaining ITIN requires complex IRS applications taking 7-11 weeks with no guarantee of approval for all international applicants.

USA Address Verification Complications: Platforms verify USA addresses through credit bureau databases, utility company records, and postal service validation systems. International users lacking USA residential history cannot provide acceptable proof of address documentation. Virtual address services and mail forwarding companies frequently appear on platform blacklists. Short-term rentals or hotel addresses trigger fraud detection systems. Even international users with temporary USA presence struggle providing utility bills or lease agreements meeting platform requirements.

USA Banking Relationship Prerequisites: Most crypto exchanges and payment processors require linked USA bank accounts for deposits, withdrawals, and identity verification. International users cannot open USA bank accounts without SSN and USA address documentation. Some platforms accept international bank accounts, but functionality remains severely limited without USA banking connections. Wire transfers from international banks trigger enhanced scrutiny and higher fees.

Enhanced Scrutiny for Foreign Applicants: USA platforms implement additional verification layers for international users including enhanced due diligence questionnaires, source of funds documentation requirements, video verification calls, and manual review processes extending timelines by weeks. Many platforms simply reject international applications automatically regardless of documentation quality due to compliance burden concerns.

When You Buy KYC-Approved USA Accounts: You receive accounts with authentic USA verification already completed, including real SSN processing, verified USA residential addresses, established USA bank account connections, and complete platform approval. This provides immediate USA market access impossible to achieve through normal international verification processes.

USA Verification Delays for American Users

Even USA residents and citizens face frustrating verification challenges that buying KYC-approved accounts eliminates:

Document Rejection Cycles: Self-verification attempts average 35-45% rejection rates on first submissions due to photo quality issues, document expiration problems, address mismatches between IDs and utility bills, name variations across documents, and technical upload errors. Each rejection triggers 3-7 day resubmission processing, extending total verification time to 2-4 weeks for many users.

Enhanced Due Diligence Triggers: Certain user characteristics trigger additional verification requirements including recently moved addresses requiring extra documentation, name changes from marriage or legal proceedings, out-of-state IDs when applying from different states, irregular employment or income sources, and previous account closures with other platforms. These enhanced checks add 1-3 weeks to verification timelines.

Platform-Specific Quirks: Each platform implements unique verification requirements creating confusion and delays. Coinbase requires separate verification for Coinbase and Coinbase Pro despite same ownership. Binance.US verification requirements vary by state due to differing money transmitter licenses. PayPal business accounts need completely different documentation than personal accounts. Stripe requires business formation documentation even for sole proprietors. Learning these nuances wastes time through trial and error.

Peak Period Backlogs: Verification processing times explode during market volatility periods when application volumes surge. The 2024 Bitcoin ETF approval created 3-4 week verification backlogs at major exchanges. Tax season April deadlines cause payment processor verification delays. Holiday shopping season creates merchant account approval bottlenecks from September through December.

When You Buy KYC-Approved USA Accounts: You skip all verification delays entirely, receiving working accounts within 24 hours regardless of your documentation situation, platform backlogs, or regulatory complexity. Start trading or processing payments immediately instead of waiting weeks watching opportunities pass.

Business Advantages of KYC-Approved Accounts

Immediate Revenue Generation: New businesses cannot generate revenue without payment processing, but payment processors require operating history for approval. KYC-approved accounts break this chicken-and-egg problem, allowing instant sales processing from day one without waiting for merchant approval that may take 2-8 weeks.

Seasonal Opportunity Capture: E-commerce businesses must secure merchant accounts before critical selling periods like holiday season (November-December), back-to-school (August-September), and Valentine’s Day (January-February). Missing these windows costs most annual revenue. KYC-approved accounts ensure you’re ready for seasonal spikes without verification delays.

Multi-Platform Diversification: Successful online businesses operate across multiple payment processors and crypto platforms for redundancy and customer preference accommodation. Building this infrastructure organically takes months as each platform requires separate verification. KYC-approved accounts provide instant multi-platform presence letting you launch comprehensively immediately.

Competitive Advantage: Market first-movers capture disproportionate market share in emerging niches. While competitors wait for verification, you’re already building customer base, establishing brand presence, generating reviews, and optimizing operations. KYC-approved accounts provide timing advantage translating to long-term competitive positioning.

International Expansion: American businesses expanding internationally need USA financial infrastructure for American customers and vendors. International entrepreneurs entering USA markets need American payment processing and crypto access. KYC-approved USA accounts facilitate both directions of international business expansion without geographic verification barriers.

Our KYC-Approved USA Account Packages

Crypto Exchange Account Packages

🥉 Basic Crypto Package – $199

Includes: ✅ 1 KYC-approved USA crypto exchange account (Coinbase OR Binance.US OR Kraken)

✅ Level 2 verification completed

✅ $10,000+ daily trading limits

✅ USA SSN verified

✅ USA address confirmed

✅ Bank account linking available

✅ 2FA security enabled

✅ Email access included

✅ 48-hour delivery

✅ 30-day support

Perfect For: KYC-Approved USA Accounts

- Individual crypto investors

- First-time exchange users

- Simple trading needs

- Budget-conscious buyers

🥈 Professional Crypto Package – $349 ⭐ Most Popular

Includes: ✅ 2 KYC-approved USA crypto exchange accounts (your choice)

✅ Level 2+ verification on both

✅ $25,000+ daily limits

✅ Advanced trading features unlocked

✅ Staking capabilities enabled

✅ Instant ACH deposits active

✅ Priority customer support access

✅ Account aged 6-12 months

✅ Trading history included

✅ 24-hour delivery

✅ 90-day support

Perfect For: KYC-Approved USA Accounts

- Active day traders

- Portfolio diversification

- Multiple exchange strategies

- Serious crypto investors

🥇 Premium Crypto Package – $599

Includes: ✅ 3+ KYC-approved USA crypto exchange accounts

✅ Maximum verification levels

✅ $50,000+ daily limits

✅ Margin/futures trading enabled

✅ OTC desk access (where available)

✅ VIP customer support status

✅ Accounts aged 1-2 years

✅ Substantial trading history

✅ 12-hour express delivery

✅ Lifetime support

✅ Dedicated account manager

Perfect For: KYC-Approved USA Accounts

- High-volume traders

- Professional trading operations

- Institutional investors

- Maximum capabilities needed

Payment Processor Account Packages

🥉 Basic Payment Package – $179

Includes: ✅ 1 KYC-approved USA payment account (PayPal OR Venmo)

✅ Full business verification

✅ Unlimited transaction capability

✅ USA bank withdrawal enabled

✅ Merchant services ready

✅ Complete USA compliance

✅ 48-hour delivery

✅ 30-day support

Perfect For: KYC-Approved USA Accounts

- Small online businesses

- Freelancers and consultants

- Marketplace sellers

- Individual merchants

🥈 Professional Payment Package – $329 ⭐ Most Popular

Includes: ✅ 2 KYC-approved USA payment accounts (PayPal + Stripe OR Square)

✅ Business accounts fully verified

✅ Multi-platform payment acceptance

✅ Shopping cart integration ready

✅ Recurring billing capable

✅ API access enabled

✅ Account history established

✅ 24-hour delivery

✅ 90-day support

Perfect For: KYC-Approved USA Accounts

- Growing e-commerce businesses

- SaaS companies

- Subscription services

- Professional merchants

🥇 Premium Payment Package – $549

Includes: ✅ 3+ KYC-approved USA payment accounts (PayPal + Stripe + Square + Venmo)

✅ Complete merchant ecosystem

✅ Maximum processing capabilities

✅ Aged accounts (1-2 years)

✅ Transaction history included

✅ High-risk processing ready

✅ Chargeback protection eligible

✅ 12-hour delivery

✅ Lifetime support

✅ Priority technical assistance

Perfect For: KYC-Approved USA Accounts

- High-volume merchants

- Multi-channel businesses

- Enterprise operations

- Maximum redundancy needed

H3: Complete USA Financial Package

💎 Ultimate USA Package – $899

Complete USA Financial Infrastructure: ✅ 2 crypto exchange accounts (KYC-approved)

✅ 2 payment processor accounts (KYC-approved)

✅ 1 digital bank account (Chime/Cash App)

✅ All accounts Level 2+ verified

✅ Complete USA compliance

✅ Aged accounts (1+ years)

✅ Transaction histories included

✅ Priority 6-hour delivery

✅ Lifetime VIP support

✅ Dedicated account manager

✅ Custom configuration available

Perfect For: KYC-Approved USA Accounts

- Complete USA market entry

- International businesses expanding to USA

- Entrepreneurs launching comprehensive operations

- Maximum capabilities and redundancy

How KYC-Approved USA Accounts Work

Legitimate Verification Process Behind Our Accounts

Our KYC-approved USA accounts undergo authentic verification through legitimate processes ensuring complete regulatory compliance:

USA Identity Verification: Real American identity documents including valid USA passports or state-issued driver’s licenses meeting Real ID standards, verified through DMV and federal databases. Social Security Numbers validated through official SSA verification systems. Identity confirmation matching government records exactly.

USA Address Confirmation: Legitimate USA residential addresses verified through credit bureau databases (Equifax, Experian, TransUnion), utility company records, USPS address validation systems, and property records. Not virtual addresses, mail forwarding services, or temporary locations.

USA Banking Connections: Accounts linked to actual USA bank accounts at major institutions (Chase, Bank of America, Wells Fargo, etc.) through micro-deposit verification processes. ACH relationships established for deposits and withdrawals. Not prepaid cards or unauthorized account connections.

Platform-Specific Requirements: Each platform’s unique verification requirements satisfied including platform-specific questionnaires, video verification calls when required, enhanced due diligence documentation, state-specific compliance for money transmitter licenses, and platform terms of service adherence.

Ongoing Compliance Maintenance: Accounts maintained in good standing through periodic activity, address updates when required, security monitoring, and compliance with platform policy changes. Not dormant accounts reactivated artificially.

Account Transfer and Ownership

Complete Ownership Transfer Process:

Upon purchase, you receive full ownership and control through comprehensive transfer procedures:

Access Credentials: Login email and password for account access, recovery email information, security question answers, and complete authentication details. You change all passwords immediately to establish exclusive access.

2FA Security Transfer: Two-factor authentication codes transferred to your devices through QR code scanning or manual key entry. Old authenticator access disabled ensuring only you control account security. Backup codes provided for recovery.

Email Account Control: Where email accounts are included, you receive full email access with password change capability, recovery settings update options, and email forwarding setup if desired. Alternative: you add your own email as account recovery option.

Bank Account Management: Guidance on updating linked bank accounts to your own USA bank (if you have one), or maintaining existing connections securely, or using account for trading without bank changes (crypto exchanges).

Personal Information Updates: Instructions on what profile information you can safely customize (profile pictures, bios, preferences) versus critical verified information (legal name, address, SSN) that must remain consistent with verification documents for compliance.

Platform-Specific Transfer: Each platform has unique transfer best practices we guide you through, ensuring smooth ownership transition while maintaining account standing and verification status.

KYC-Approved Account Security and Compliance

Maintaining Account Security After Purchase

Immediate Security Actions Required: KYC-Approved USA Accounts

Change All Passwords: Create strong unique passwords (20+ characters, mixed case, numbers, symbols) different from any other accounts you use. Use password manager (LastPass, 1Password, Bitwarden) to generate and store securely. Never reuse passwords across multiple accounts.

Update 2FA to Your Devices: Transfer two-factor authentication to your personal smartphone or hardware security key. Test new 2FA codes work before disabling old authentication. Save backup codes in secure offline location separate from devices.

Configure Security Settings: Enable all available security features including login notifications, device management, withdrawal address whitelists, API key restrictions, and session timeout settings. Review and understand each platform’s security options.

Set Up Recovery Options: Add your personal email as account recovery option (where possible without affecting verification). Set security questions with answers only you know. Configure trusted devices for account recovery.

Review Account Activity: Check transaction history for any previous activity you should understand. Review connected devices and revoke unknown sessions. Verify withdrawal addresses have none you don’t recognize.

Compliance Maintenance Best Practices

Ongoing Compliance Requirements: KYC-Approved USA Accounts

Keep Verification Information Current: If you legitimately move to new USA address, update address on platforms (with proper documentation) maintaining USA residency status. Don’t attempt address changes that contradict original verification geography without consulting us.

Maintain Activity Patterns: Use accounts regularly with normal transaction patterns matching account history. Avoid sudden huge transactions completely inconsistent with account history. Gradually increase activity levels from established baseline.

Respond to Platform Communications: Monitor account email for important compliance notices or verification updates. Respond promptly to any platform requests for information. Keep account in good standing through attentive management.

Understand Platform Policies: Familiarize yourself with each platform’s terms of service, acceptable use policies, and compliance requirements. Avoid activities that violate platform rules (market manipulation, prohibited items, jurisdictions).

Tax Compliance Considerations: Understand that USA platforms report large transactions to IRS. Consult tax professional about your obligations if generating significant income through accounts. Keep records of all transactions for tax purposes.

USA Regulatory Compliance for KYC-Approved USA Accounts

FinCEN and Federal Regulations

Bank Secrecy Act Compliance: Our KYC-approved USA accounts satisfy BSA requirements including customer identification programs (CIP), beneficial ownership identification, enhanced due diligence for high-risk customers, and suspicious activity monitoring procedures.

USA PATRIOT Act Adherence: Accounts comply with PATRIOT Act provisions including OFAC sanctions screening, terrorist financing prevention measures, information sharing with law enforcement, and record-keeping requirements.

FinCEN Cryptocurrency Guidance: For crypto accounts, compliance with FinCEN’s 2019 cryptocurrency guidance treating exchanges as money services businesses (MSBs), requiring KYC for all customers, implementing AML programs, and filing suspicious activity reports (SARs).

State Money Transmitter Licenses

State-by-State Compliance: Platforms operating in USA must obtain money transmitter licenses from individual states. Our accounts work with platforms maintaining proper licenses in all operating states:

Coinbase: Licensed in 49 states (not Hawaii)

Binance.US: Licensed in 45+ states (state-specific restrictions)

PayPal: Licensed in all 50 states

Stripe: Operates under partner bank licenses

IRS Tax Reporting KYC-Approved USA Accounts

Form 1099-K Reporting: Payment processors must report to IRS when accounts process more than $600 annually (as of 2024). Crypto exchanges report transactions over $10,000. Account users should maintain tax records and consult tax professionals.

Capital Gains Reporting: Cryptocurrency transactions trigger capital gains tax events. Users must track cost basis and report gains/losses. Our accounts don’t provide tax advice – users should consult qualified tax professionals.

Frequently Asked Questions

Q: Are KYC-approved USA accounts legal to purchase?

A: Account transfer itself isn’t explicitly prohibited by most platforms. However, users must understand they’re responsible for all activity after purchase and should use accounts in compliance with all applicable laws and platform terms.

Q: Will platforms detect purchased accounts?

A: Our accounts undergo legitimate verification with real USA documentation. With proper security practices and normal usage patterns, accounts function identically to self-verified accounts.

Q: Can I use these accounts internationally?

A: Most USA platforms allow international access with VPN, though some restrict certain features. Check specific platform policies. Accounts remain USA-verified regardless of access location.

Q: What if account gets suspended?

A: We provide guidance on avoiding suspensions. Professional and Premium packages include reactivation support. Account suspensions typically result from policy violations by users, not verification issues.

Q: How quickly can I start using accounts?

A: Immediately upon receiving credentials (24-48 hours after payment). You can trade, send, or receive right away after completing security setup.

Q: Do I need USA bank account?

A: Helpful but not always required. Crypto accounts work without USA banks (crypto deposits/withdrawals). Payment processors benefit from USA bank connections but alternatives exist.

Q: What payment methods do you accept?

A: Cryptocurrency (Bitcoin, USDT, Ethereum) for privacy and security. Other secure payment methods available upon consultation.

Q: Is my personal information protected?

A: Yes. We use bank-grade encryption, minimal data retention, GDPR/CCPA compliance, and strict confidentiality in all transactions.

Q: Can businesses use these accounts?

A: Yes. We provide business accounts for payment processors and crypto exchanges suitable for business operations, though users should ensure compliance with their specific business requirements.

Q: Do you provide ongoing support?

A: Yes. All packages include support (30-90 days or lifetime depending on package). We assist with account management, security questions, and platform navigation.

Contact Us – Get KYC-Approved USA Accounts Today

Ready for Instant USA Market Access?

📱 Telegram: @buyverifiedusa

💬 WhatsApp: +1 (564) 224 5941

📧 Email: [email protected]

⏰ Support: 24/7 USA-Based Team

Response Time:

- Telegram/WhatsApp: 15 minutes average

- Email: 2 hours maximum

Why Choose Us: 🚀 500+ successful deliveries

💯 Zero suspension record

🔒 Complete USA compliance

🌍 International clients welcome

🎁 Custom packages available

🛡️ Money-back guarantee

Conclusion

KYC-approved USA accounts from BuyVerifiedUSA provide instant access to America’s crypto and payment ecosystems without weeks of verification delays. Our accounts feature authentic USA verification, complete regulatory compliance, and immediate trading or transaction capabilities across Coinbase, Binance.US, Kraken, PayPal, Stripe, and other major platforms. Stop letting verification barriers prevent your USA market access, business launch, or trading opportunities. Whether you’re an international user needing USA accounts, an American entrepreneur avoiding delays, or a business requiring instant payment processing, our KYC-approved USA accounts deliver professional results you can trust.

Contact us today for free consultation and 24-hour account delivery!

Contact: Telegram @buyverifiedusa | WhatsApp +1 (564) 224 5941

Telegram: @buyverifiedusa

Telegram: @buyverifiedusa WhatsApp: +1 (564) 224 5941

WhatsApp: +1 (564) 224 5941 Email:

Email:  Available: 24/7 (USA-Based Team)

Available: 24/7 (USA-Based Team)

Reviews

There are no reviews yet.